Agencies Shed Some Light on the Waiting Period Restrictions Under PPACA

By Kristi R. Gauthier, Esq.

By Kristi R. Gauthier, Esq.

Clark Hill PLC

May 2013 – The Departments of Labor, Health and Human Services and Treasury (“Agencies”) issued proposed regulations on the waiting period restrictions imposed by the Patient Protection and Affordable Care Act (PPACA). Under these provisions, effective with plan years beginning on and after January 1, 2014, employers are prohibited from imposing waiting periods applicable to their group health plans that exceed 90 calendar days.

For these purposes, a “waiting period” is the period of time that must pass before an eligible employee or dependent may enroll in the coverage under the group health plan. To be an “eligible” employee or dependent means that the individual has otherwise satisfied the eligible criteria under the terms of the group health plan (e.g., eligible job classification). Below are some of the key concepts employers should understand with regard to these provisions:

90 days means 90 days! The proposed regulations make it clear that the waiting period cannot exceed 90 days, and all calendar days are counted. Therefore, if the 91st day falls on a weekend or holiday, and due to administrative constraints the employee cannot be enrolled on that day, the employer must make coverage effective earlier than the 91st day. This also means that provisions such as “the first of the month following 90 days” will no longer be permissible.

The waiting period restrictions apply regardless of grandfathered plan status or employer size.

The provisions do not mandate a waiting period. Employers are not required to impose a waiting period for their group health plans, but rather if they elect to do so, it cannot exceed 90 calendar days.

The 90-day waiting period limitation does not apply to HIPAA-excepted benefits (e.g. standalone dental and vision plans, most health flexible spending accounts, fixed indemnity insurance, specified disease/illness policies, etc.).

Plan provisions that base eligibility on conditions other than the lapse of time are permissible so long as they are substantive and are not designed to avoid compliance with the 90-day waiting period restrictions (e.g., meeting certain sales goals, a specified level of commission, certain number of hours per period, etc.).

Cumulative hours of service requirements that do not exceed 1,200 hours are permissible, and the waiting period of no more than 90 days must begin once the new employee satisfies the cumulative hours of service requirement. However, employers should be cautious so as to not violate the employer shared responsibility provisions and open themselves up to potential penalties.

Currently there are no special exemptions or delayed effective dates for collectively bargained or multiemployer plans.

As always, it is important for employers to work closely with their legal counsel, benefits consultants, third party administrators and/or insurers to ensure compliance with PPACA. Employers should review their current group health plan waiting periods to ensure that it does not impose a waiting period of greater than 90 days after January 1, 2014 (or as of the start of the first plan year beginning after January 1, 2014 if the employer operates on a non-calendar year basis). Employers should also review, and amend where necessary, any group health plan documentation that details waiting periods such as plan documents, summary plan descriptions, underlying insurance certificates, employee handbooks, open enrollment materials, etc.

*This article is not intended to give legal advice. It is comprised of general information. Employers facing specific issues should seek the assistance of legal counsel.

Kristi R. Gauthier is a senior attorney in Clark Hill’s Birmingham office and concentrates her practice in Employee Benefits Law. Kristi has represented clients in a wide variety of employee benefits issues involving health and welfare benefits, as well as retirement plans. Kristi is admitted to practice in the State of Michigan, the U.S. District Court for the Eastern District of Michigan, and the U.S. Sixth Circuit Court of Appeals. She also is active in the legal community with memberships in the American Bar Association, the State Bar of Michigan, and the Oakland County Bar Association where she is a member of the Employee Benefits Committee. Kristi also serves as a member of the Clark Hill Diversity and Inclusion Committee. Kristi has lectured on various employee benefits issues, including ERISA compliance, healthcare reform, COBRA, section 125 plans, 403(b) plans and IRS plan correction programs. Kristi is also a co-author of the ABA publication ERISA Survey of Federal Circuits. Kristi was named a “Rising Star” by Michigan Super Lawyers in 2011.

By Bonnie Bochniak

By Bonnie Bochniak By Ron Present

By Ron Present May 2013 – Beginning January 1, 2014, individuals and employees of small businesses will have access to health care coverage through the Health Insurance Marketplace. Open enrollment of health insurance coverage through the Marketplace begins October 1, 2013. Under the ACA, employers must provide a notice of coverage options to each employee, regardless of plan enrollment status or part-time or full-time status. Employers are required to provide notice to existing employees no later than October 1, 2013, and new employees at the time of hiring beginning October 1, 2013.

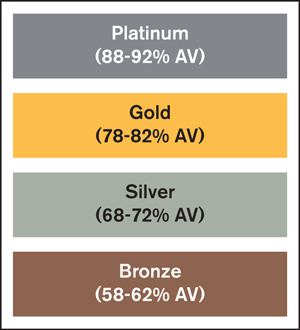

May 2013 – Beginning January 1, 2014, individuals and employees of small businesses will have access to health care coverage through the Health Insurance Marketplace. Open enrollment of health insurance coverage through the Marketplace begins October 1, 2013. Under the ACA, employers must provide a notice of coverage options to each employee, regardless of plan enrollment status or part-time or full-time status. Employers are required to provide notice to existing employees no later than October 1, 2013, and new employees at the time of hiring beginning October 1, 2013. The four metal levels are defined by actuarial value targets that a qualified health plan must achieve, plus or minus 2 percent. For example, a silver plan must have an actuarial value of 68 percent to 72 percent.

The four metal levels are defined by actuarial value targets that a qualified health plan must achieve, plus or minus 2 percent. For example, a silver plan must have an actuarial value of 68 percent to 72 percent. By Larry Grudzien, J.D.

By Larry Grudzien, J.D. By Evie Zois Sweeney

By Evie Zois Sweeney By Craig B. Garner

By Craig B. Garner

By Steve Sarns

By Steve Sarns